louisiana state inheritance tax

425 on more than 50000 of taxable income. Does Louisiana Have an Inheritance or Estate Tax.

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

When a person dies and leaves an inheritance the state must tax the wealth before the beneficiary collects their shares.

. However Louisiana is a community property state meaning that spouses jointly. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. You can trust the experienced estate planning attorneys at Dowden Smith to deliver an estate plan that protects and provides for your family.

Federal Estate Tax Return Form 706 2. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax.

Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal. Equal to the maximum tax credit for state estate or inheritance tax allowed on the federal estate tax return Pick-up tax Since 2004 federal law allows only a deduction for state inheritance. There are 38 states in the.

Louisiana does not place a tax on estates or inheritances. Louisiana Inheritance and Gift Tax. Louisiana Income Tax Range.

With the changes to the Federal Estate tax which took effect this year I have been asked by numerous clients if the Louisiana Inheritance Tax laws were changed in any way. The Economic Growth and Tax Relief Reconciliation Act of. R-3318 1108 1402 Schedule IV Tax Reduction and Determination of Louisiana Estate Transfer Tax 1 Total state death tax credit allowable Per US.

1 Total state death tax credit allowable Per US. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax. Thus there is no requirement to file a return with the State and no state inheritance.

The Economic Growth and Tax Relief Reconciliation Act of. The inheritance could be money or property. Louisiana Inheritance Tax Laws.

The Economic Growth and Tax Relief Reconciliation Act of. Louisiana law used to require that an inheritance tax return be filed with the Louisiana Department of Revenue before a succession was opened. When you go through probate administration its important to keep in mind the specific state laws for taxes and seek legal advice.

185 on 12500 or less of taxable income for individuals 25000 for joint filers High. While the estate is responsible for paying estate taxes beneficiaries must pay inheritance tax. The state taxes any retirement income.

LOUISIANA STATE INHERITANCE TAX The State of Louisiana has repealed all state inheritance taxes. Call our office today at 337. The potential INCOME tax rate on that built in gain even if all of it is classified as a capital gain is 26 20 federal capital gains tax 6 Louisiana top income tax rate.

Estate Planning In Louisiana 4th Edition A Layman S Guide To Understanding Wills Trusts Probate Power Of Attorney Medicaid Living Wills Taxes Rabalais Paul A 9781985235168 Amazon Com Books

Home Page Louisiana Department Of Revenue

Complete Guide To Probate In Louisiana

State Tax Levels In The United States Wikipedia

State Death Tax Hikes Loom Where Not To Die In 2021

Losavio Dejean Louisiana Estate Planning And Elder Law Firm

Pdf The Federal Estate Tax History Law And Economics Semantic Scholar

Louisiana Health Legal And End Of Life Resources Everplans

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

How Do State And Local Property Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

![]()

Louisiana Succession Taxes Scott Vicknair Law

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

States With No Estate Tax Or Inheritance Tax Plan Where You Die

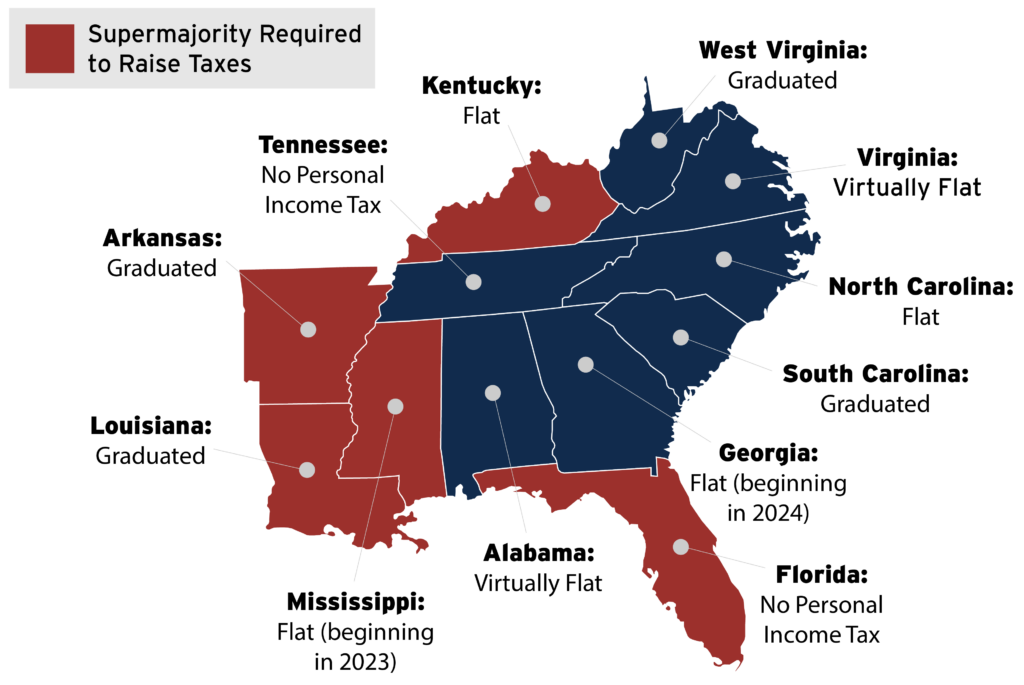

Creating Racially And Economically Equitable Tax Policy In The South Itep

Estate Planning In Louisiana 4th Edition A Layman S Guide To Understanding Wills Trusts Probate Power Of Attorney Medicaid Living Wills Taxes Rabalais Paul A 9781985235168 Amazon Com Books